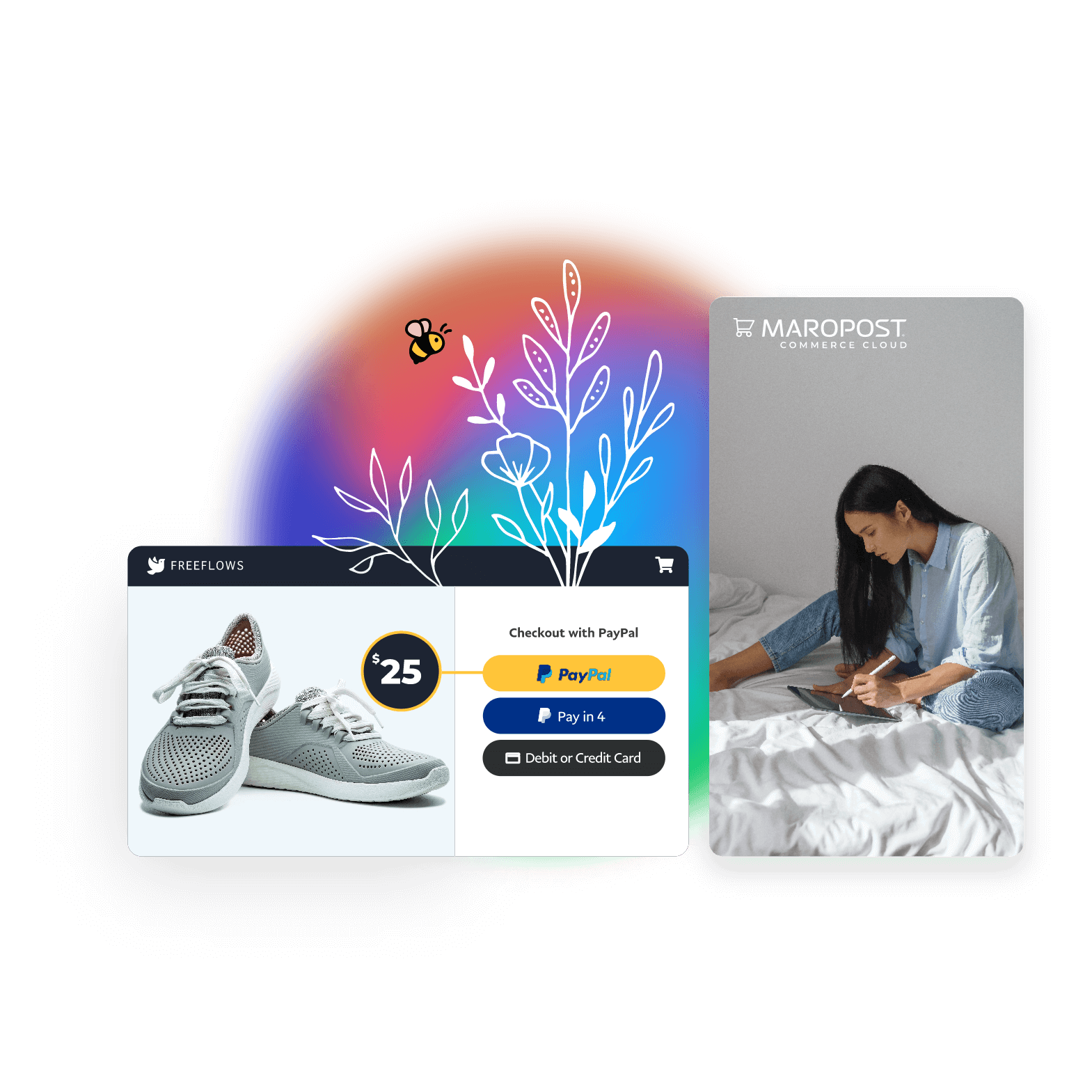

Offer all major payment options

with one easy checkout solution

With PayPal, you can provide your customers many payment types in one seamless checkout experience. Whether your business is online, in-store, or on-the-go, PayPal helps you connect with customers and expand the reach of your business.

*Product name may vary by region - Venmo is only available in the USWhat Pay Later can mean for your Bottom Line

63%

More likely to purchase

Almost two-thirds of buy now, pay later (BNPL) users say they are more likely to complete a purchase if a BNPL option is available.7

39%

increase in cart sizes.

increase in average order value (AOV) — businesses with pay-over-time messaging on their site saw a 56% increase in overall PayPal AOV.5

84%

look for it before checkout.

The majority of buy now, pay later (BNPL) users decide to use a BNPL solution prior to checkout.8

PayPal is one of the world’s most preferred, trusted, and familiar brands

20+

years of experience

200+

markets around the globe

100+

different currencies

Pay Later is good for business

Help increase sales.

Give customers more spending power and help boost your average order values.

#1 trusted brand.

Rated most trusted brand across buy now, pay later providers.5

Get paid up front.

And let customers spread their payments over time.

No additional costs.

Pay Later is already included with your PayPal Checkout at no additional cost.

Attract NextGen customers.

Millennials and Generation Z consumers plan to use BNPL more than other age groups.6

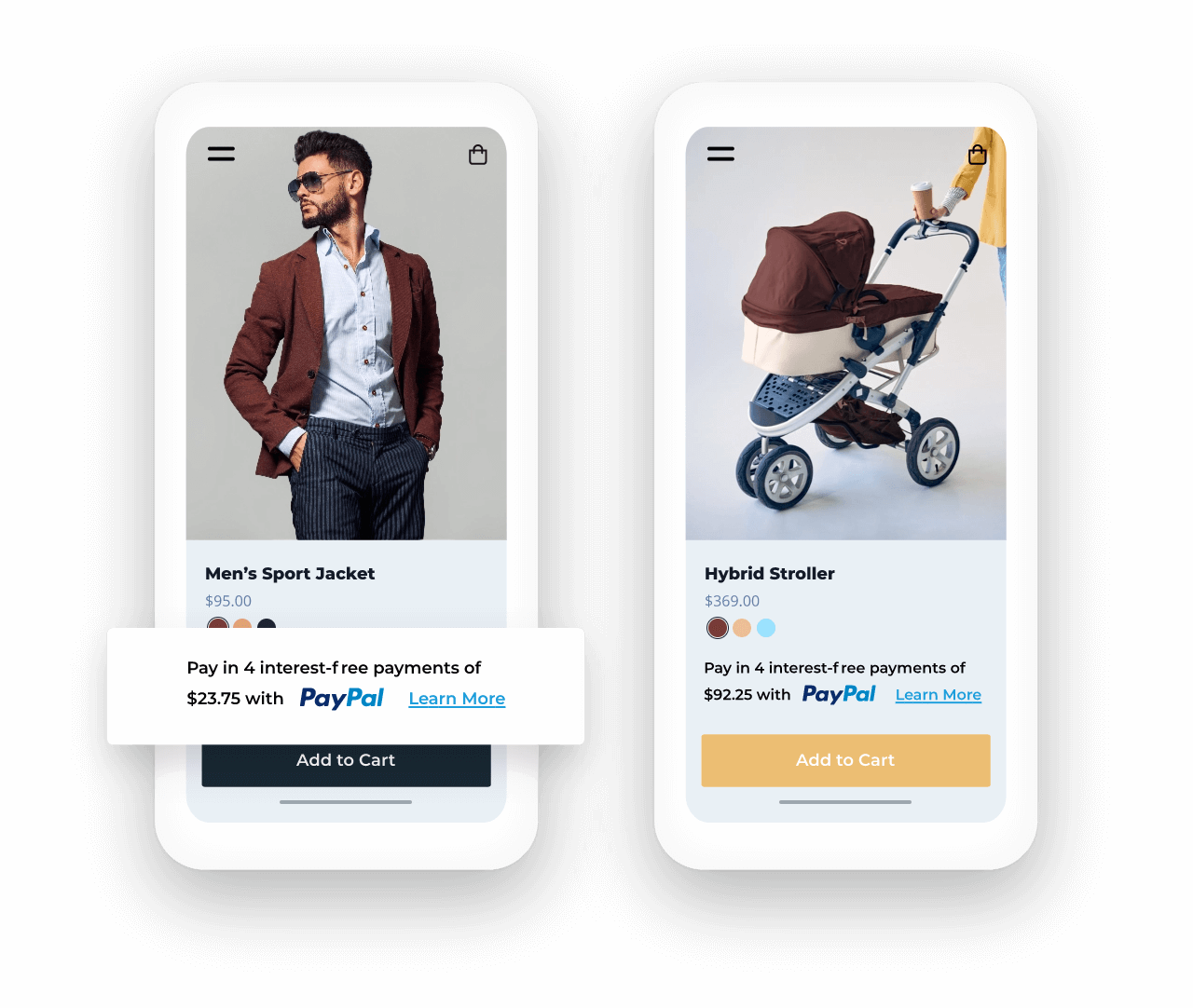

Easy promotion

Add dynamic Pay Later messaging to your site with a single integration.

Avoid friction with our easy checkout process

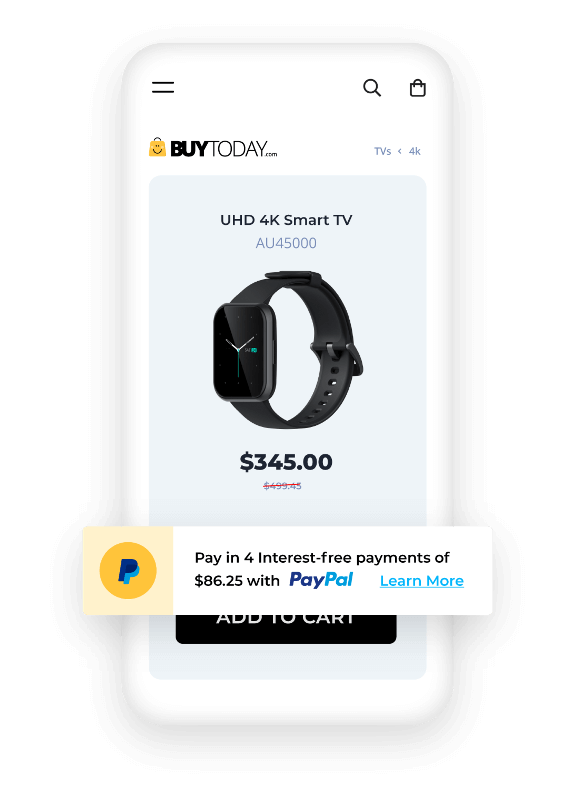

Show dynamic Pay Later messaging on your site.

Once enabled, dynamicmessaging will display the most relevant Pay Later offer — either Pay in 4 or Pay Monthly —to your customers while they're shopping.

Your customer sees the most relevant Pay Later option.

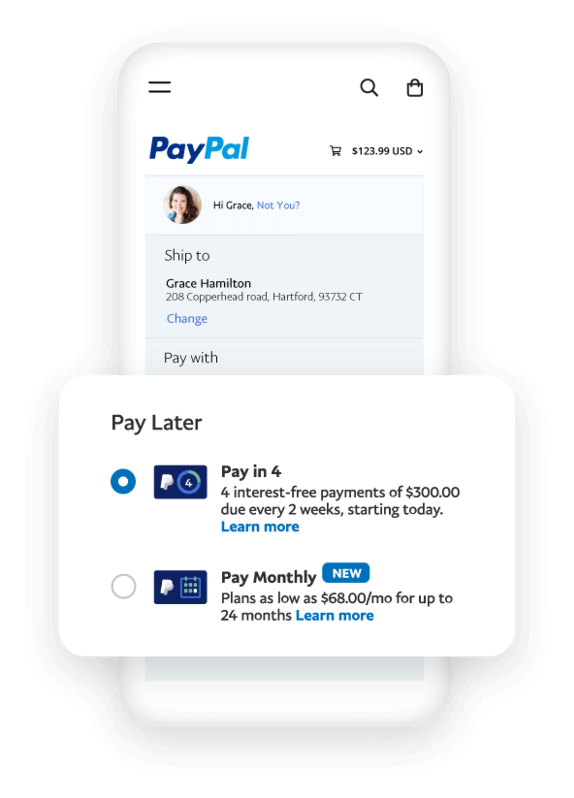

Customers choose between Pay in 4 or Pay Monthly at checkout.

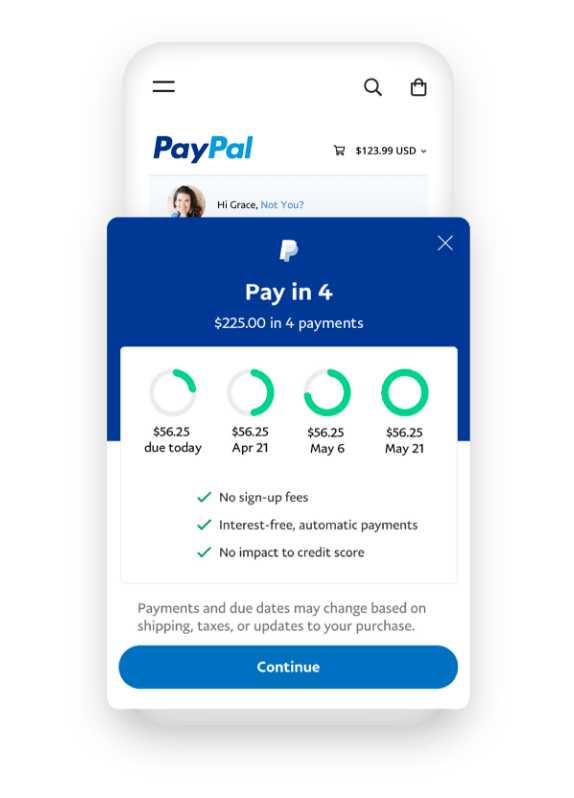

Customers get clear payment information.

Pay in 4 or Pay Monthly payments are clearly presented.

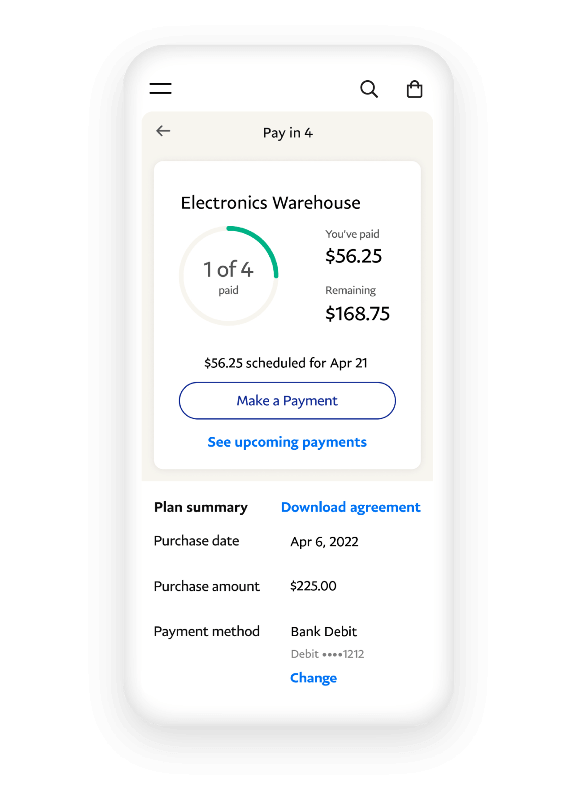

PayPal does the rest.

Once the order is processed, you get paid up front. And PayPal takes care of collecting payments from your customers.

Setting up PayPal for your Commerce Cloud Site is so easy:

2.

Payment Methods

In your Maropost Commerce control panel navigate to Settings & Tools > Payment Methods.

3.

Complete Setup

In the PayPal section and click the Complete Setup button.

Not a Maropost customer? Start a free trial to get started!

*About Pay in 4: Loans to California residents are made or arranged pursuant to a California Financing Law License. PayPal, Inc. is a Georgia Instalment Lender Licensee, NMLS #910457. Rhode Island Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. 9.99-29.99% APR based on the customer’s creditworthiness. PayPal, Inc.: RI Loan Broker Licensee. The lender for Pay Monthly is WebBank.

162% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

2PayPal's Pay Later is boosting merchant conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

380% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November. 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357).

474% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

5PayPal is the most trusted brand across BNPL payment providers. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

6The Truth About BNPL And Store Cards Report, an online study commissioned by PayPal and conducted by PYMNTS, based on a census- balanced survey of 2,161 U.S. consumers from Dec. 10 to Dec. 17, 2021.

7TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU(n=447), FR (n=255).

884% of BNPL users decide to use a buy now pay later solution prior to checkout. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL users, n=357).

The PayPal service is provided by PayPal Australia Pty Limited (ABN 93 111 195 389) which holds Australian Financial Services Licence number 304962. Any information provided is general only and does not take into account your objectives, financial situation or needs. Please read and consider the Combined Financial Services Guide and Product Disclosure Statement before acquiring or using the service. To review the Target Market Determination, see website.